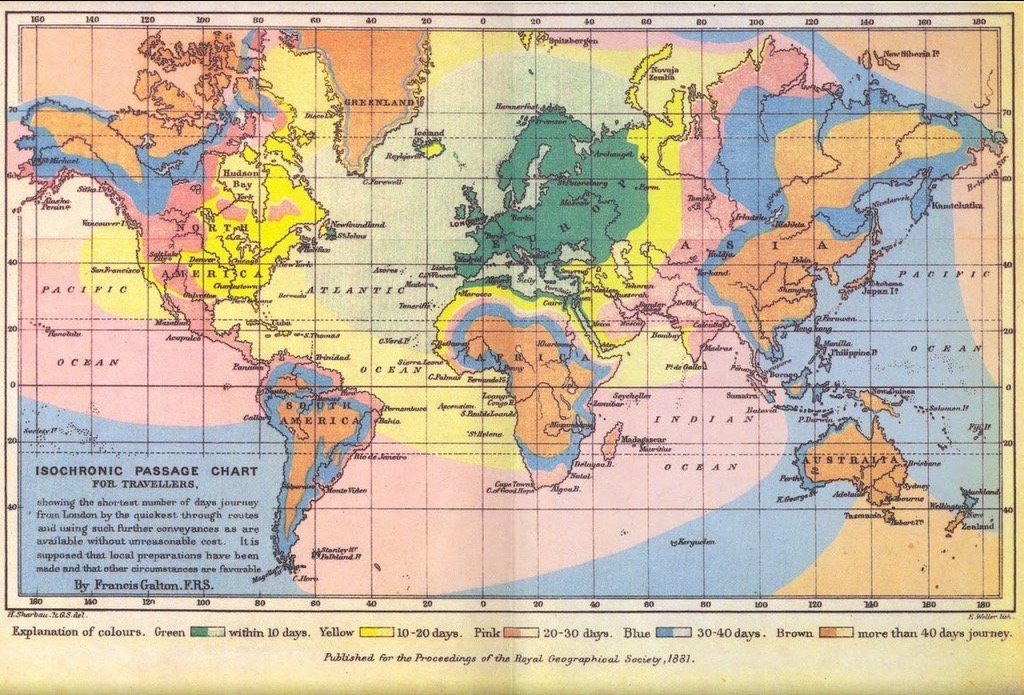

I love the map above, a 1881 Isochronic Chart showing travel time from London under optimum conditions. Which should help understanding the travel time for casks of British beer from that year and perhaps quite a few decades before. Or at least it can be adjusted by a factor. In 1732 the ship Ann crossed the Atlantic, from London to the not-yet colony of Georgia in 88 days. Note how in 1881 Nova Scotia and a bit of Newfoundland are green, meaning transit could occur under ten days. Or about an eleventh of an Ann. Neato. More here.

Gary: Bass master… not Bassmaster. Got it?

Archaeologist Merryn Dineley, is making some great points on Twitter these days about the lack of respect and role of malt and malting through time, both today and and in particular in relation to the study of Stonehenge.

Yup.

Ha ha! Stone sued a party that had nothing to do with it. Will they pay their legal costs? Is that the reason for the delay?

The forces of “don’t worry, be happy” are out in force this week given that the news broke that the assets of Green Flash, the 43rd largest US craft brewery, have been sold off. As the Full Pint reported on Tuesday, this is part of the official memo that Green Flash President and CEO Mike Hinkley sent to over 100 shareholders:

On behalf of myself and the Board of Directors of GFBC, Inc. (the “Company”), I am truly sorry to report that the Company’s senior lender, Comerica Bank, has foreclosed on its loans and sold the assets of the Company (other than the Virginia Beach brewery) to WC IPA LLC through a foreclosure sale which closed on March 30, 2018. As such, the Company no longer owns the Green Flash and Alpine businesses. Comerica Bank is currently conducting a separate process to sell the Virginia Beach brewery. After a general slowdown in the craft beer industry, coupled with intense competition and a slowdown of our business, we could not service the debt that we took on to build the Virginia Beach brewery — and in early 2018, the Company defaulted on its loans with Comerica Bank.

Note a few things. The shareholders were not aware of the decision made apparently by the main shareholder, the lender whose loan bounced. The were told after the fact. I expect that indicates that the lender got the power to do that in a loan agreement. It also might indicate that this was not the first loan agreement as gaining that short of shareholder control is not the stuff of ordinary loan agreements. The failing of the business has being going on for some time. Also, these are asset sales. This is not a foreclosure of the business.* The brewing company has not been sold off, just the assets of value. Including the “businesses” which would include the brands, the goodwill if any is left and all operational aspects. So, the corporation has been stripped to pay the bank. Reason? Forget the other stuff – over extension of debt to move into the branch plant business. The only question that matters is whether others will be found to be in the same boat.

Craft was in the news for other reasons. The Wall Street Journal declared craft beer was “big business.” [Note: “big craft” was discussed in 2014.] I like this plain language sentence in the WSJ piece in particular: “[r]ecent years have seen a world-wide wave of beer consolidation.” No “sell out!” No “got gobbled up!” Just a plain language description of the business of beer doing what it has done for hundreds of years – consolidate.

One example of a consolidation was examined in far greater detail by the Chicago Tribune in Josh Noel’s excellent article “Goose Island Aims to Shake Off Rough Year with New Beers, Ad Campaign.” The only thing I didn’t understand was this passage:

Goose Island’s story is therefore returning to Chicago — an effort to tie the brewery not just to its hometown, but to cities in general: urban and bustling, with a dose of cosmopolitan and hip. “It’s something that can be owned and is differentiating for Goose Island,” Ahsmann said. “Think about it: Can you think of any other nationally distributed craft brewer based out of a city?” There are others, of course — Brooklyn Brewery, Boston Beer Co. and Anchor Brewing in San Francisco — but none that owns the idea of city in the way that Corona is beach or Coors is mountains. Ahsmann wants Goose Island to be that beer.

If that is what Goose Island is doing under AB InBev it’s not speaking to me. I just thought Goose Island was about geese on an island. Monsieur Jonathan, Le Beerinateur, clarified on Twitter that is was a district of Chicago. Who knew? Without that context, there is no way I would think “gooseness” + “islandness” = “urban and bustling, with a dose of cosmopolitan and hip” because that math just doesn’t work for me even though I have been having the odd Goose Island IPA** since maybe 2010. [Did all you all know this and not tell me?]

Is the lesson of both Green Flash and Goose Island that US craft and local/regional are more closely tied than big craft thought? Notte note: “It’s a fine lesson…”

Celebrator ends its print run. I blame MySpace.

This is an interesting story. It’s about Catalonia’s burgeoning craft beer scene. It’s from March 2013. One key thing was left unexplored then: local sausages. No idea how they measure up compared to the sausages of other regions of Spain. That is not the point. You know, it would be nice to know what each junket sponsoring jurisdiction requires in its funding agreement by way of social media follow up content. That is for another day. Today, I am fascinated by the sudden fascination with Catalonian sausages.

You want a real beer vacation? Three words: Bavarian… theme… park.

My two favourite April Fool’s pranks: “Brewers Brace for Brettanomyces Shortage” and ^Greg, the Sunday intern for Boak and Bailey.

That’s it. I am down to the cheap shots and gags. It wears one down. More next week. Sure thing. You bet. Perhaps cheerier. No promises. No comment.

U*This could be another aspect of the over all plan.

**Or something or other under that label.